An Insurer Becomes Insolvent Which of the Following

Which of the following is the CORRECT level of coverage that Constance. The insurer can sue the.

In most states when an.

. Her insurance agent explains that Constance is provided some protection if Atwater were to become insolvent. The NAIC considers an insurer insolvent if a state insurance commissioner has taken legal action to place the insurer into liquidation rehabilitation or conservatorship. Insolvent insurer means a member insurer that.

If an insurance company is declared insolvent the state guaranty association and guaranty fund swing into action. The firm will then often enter. Violating Pennsylvania insurance law may result in which of the following Insurance Department actions.

There are a number of reasons why insurers become insolvent. Means a person who directly or indirectly through one or more intermediaries controls is controlled by or is under common control with an insolvent. Regarding landmark cases and laws involving the regulation of insurance which of the following statements is NOT correct.

A fund set aside by state insurance regulators to pay out claims to policyholders in the event an insurance company becomes insolvent. Define Affiliate of the insolvent insurer. The company did not charge adequate premiums nor did the company purchase reinsurance.

When an agent has placed business with an insurer that subsequently becomes insolvent the agent usually is not held liable for any losses sustained by the policyholder because the agent. Insurance is a highly regulated industry but that doesnt mean its failure-proof. The association will transfer the insurers policies to another.

Submitting to a medical exam when requested. A has been placed under an order of liquidation with a finding of insolvency by a court in this state or another state a minimum free. Columbus State Community College FMGT 2232.

Upon conversion the death benefit of the permanent policy will be reduced by 50. Students who viewed this also studied. Non-insurance subsidiaries or affiliates are still subject to FDIC receivership so a state regulator may find itself working with the federal government if an insurance group.

This preview shows page 4 - 7 out of 9 pages. Fly-By-Night Insurance Company had much larger losses than forecast. One possibility is that theyre.

Which of the following government entity requires an agent to refund unearned premiums and notify insureds of the insolvency. The McCarran-Ferguson Act 1945 led directly to. An insurer has become insolvent.

Provide policy owner protection if an insurer becomes insolvent. A major knock on effect of your insurer becoming insolvent is there is no set time scale for the FSCS to process any outstanding claims. Central Guarantee Fund.

In the event of a claim under a commercial general liability policy the insured has all of the following duties to the insurer EXCEPT. The insurer can refuse to a pay claim if the insured has not complied with all policy provisions. An insurance insolvency occurs when an insurer finds itself in financial difficulty and the regulator believes it wont be able to meet its liabilities.

This can have a major effect on cash flow if. The insured can assign the policy only with the insurers consent. Office of Insurance Regulation - Insurer Solvency Division.

All of the following are true regarding the convertibility option under a term life insurance policy EXECPT. Department of Financial Services - Division of.

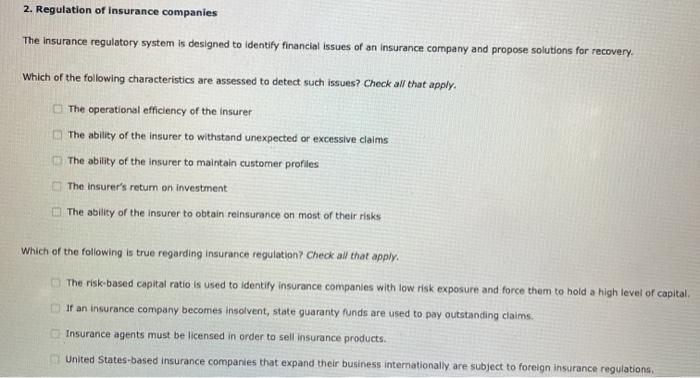

Solved 2 Regulation Of Insurance Companies The Insurance Chegg Com

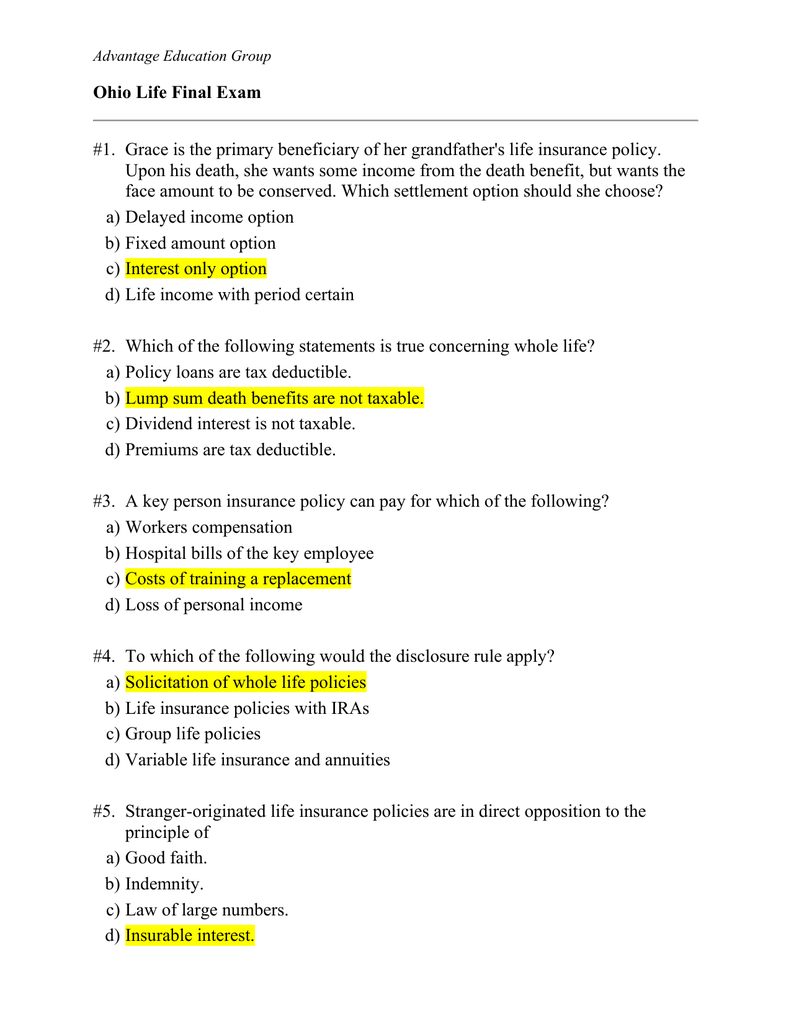

Advantage Education Group Ohio Life Final Exam Pdf Free Download

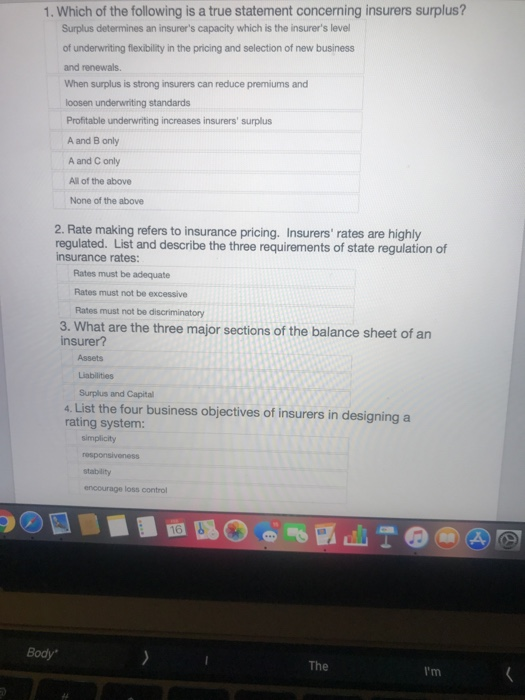

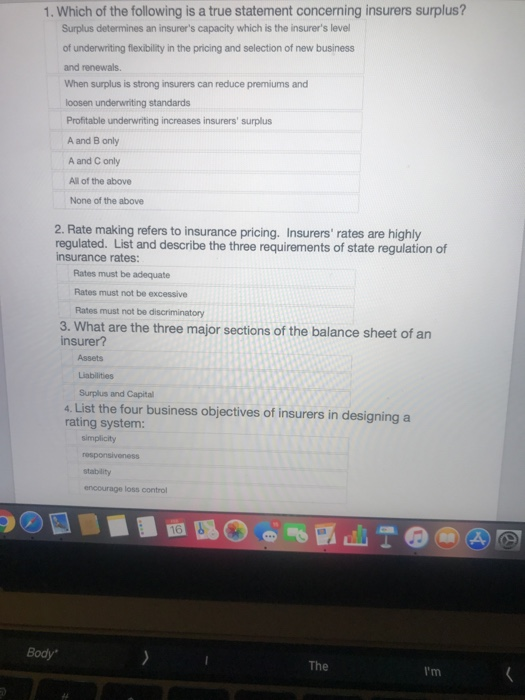

Solved 1 Which Of The Following Is A True Statement Chegg Com

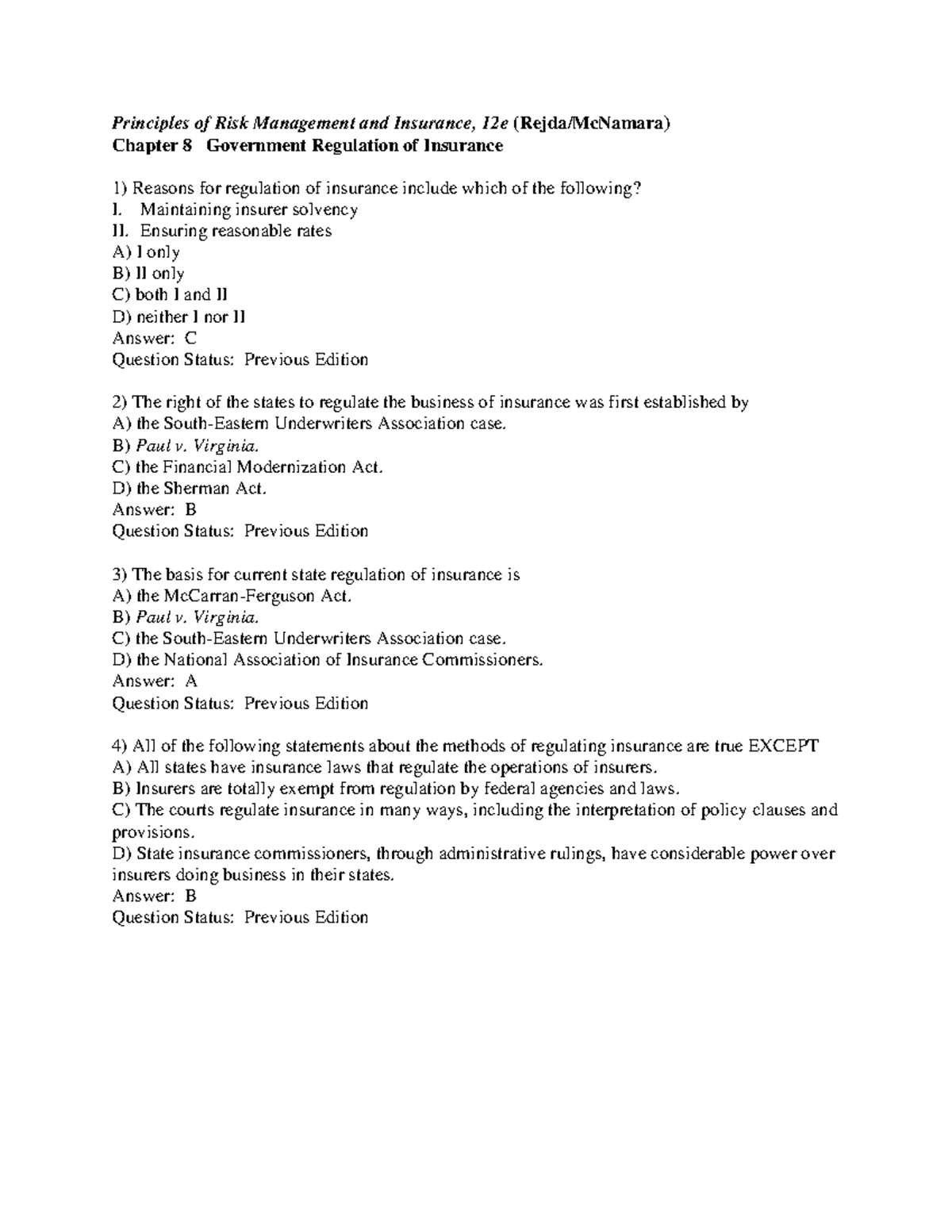

Study Questions And Answers Ch8 Principles Of Risk Management And Insurance 12e Rejda Mcnamara Studocu

No comments for "An Insurer Becomes Insolvent Which of the Following"

Post a Comment